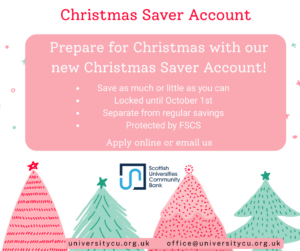

Christmas Saver Account

Plan for a Joyful Holiday Season!

Our Christmas Saver Account is designed to help you spread the cost of Christmas, making the festive season stress-free and enjoyable. Start saving today and watch your savings grow, ensuring you have the funds you need for a happy holiday.

What You Need To Know

Flexible Savings: You can save as little or as much as you like each week or month. Whether it’s £1 a week or £5 a month, every little bit adds up!

Locked Savings: To encourage saving, the account is locked until the first working day of October. You can then withdraw your savings as needed before the account is locked again on December 31st.

Peace of Mind: Your money is protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Easy Deposits: Deposit by Payroll, Standing Order, or make one-off deposits from your bank.

Annual Dividend: Earn an potential annual dividend on your savings based on surplus and directors approval.